Property taxes for residents in the state of Texas are due on January 31, 2025. The good news is, you can still pay your taxes through your local tax assessor’s office online.

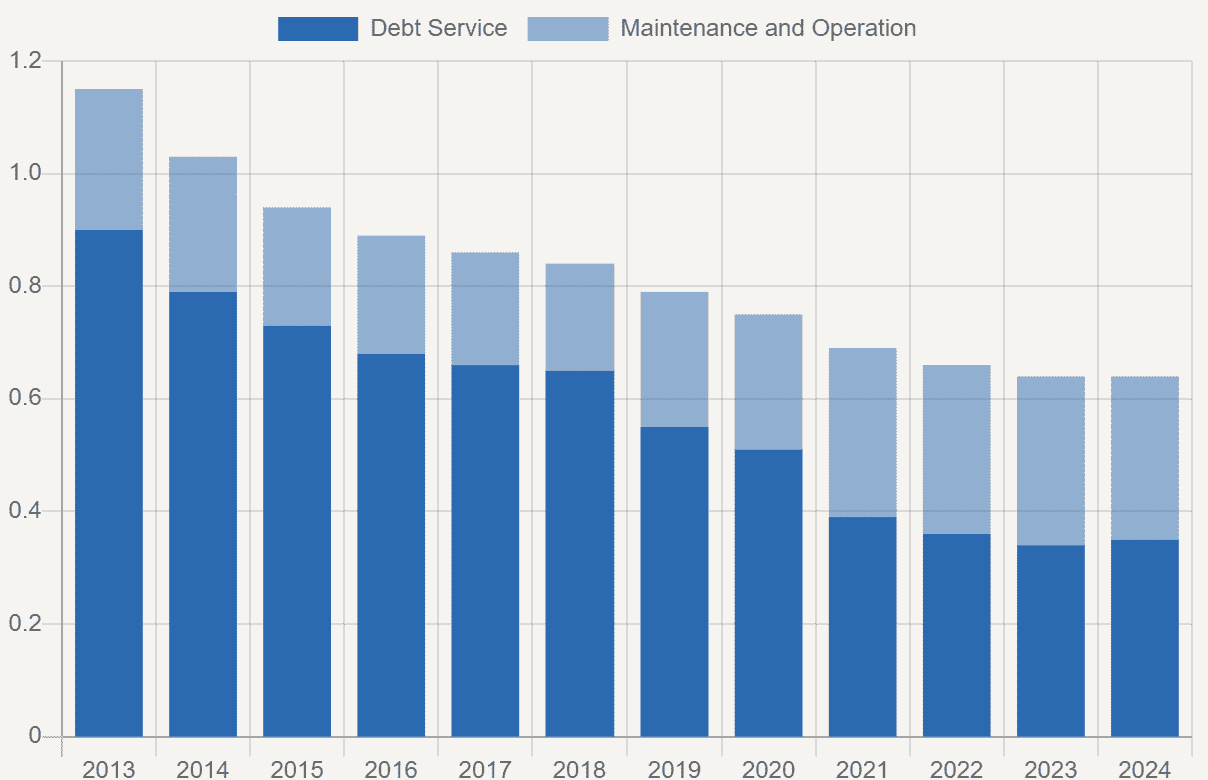

Harris County MUD 284 ad valorem Taxes rates are based on property values established by the Harris Central Appraisal District. The tax rate (below) is per $100 of home value, as determined by the Harris Central Appraisal District.

To pay your taxes, or to look up your account, go to Wheeler & Associates, Inc. and use the “Account Search” form. You can also call the Tax Information Line at 713-462-8906 or submit a question through the form on the Contact Us page of this website.

| Year | Debt Service | Maintenance | Total Tax Rate | Order Levying Taxes |

| 2024 | 0.35 | 0.29 | 0.64 | |

| 2023 | 0.34 | 0.30 | 0.65 | Order Levying Taxes – 2023 |

| 2022 | 0.36 | 0.30 | 0.66 | Order Levying Taxes – 2022 |

| 2021 | 0.39 | 0.30 | 0.69 | Order Levying Taxes – 2021 |

| 2020 | 0.51 | 0.24 | 0.75 | Order Levying Taxes – 2020 |

| 2019 | 0.55 | 0.24 | 0.79 | Order Levying Taxes – 2019 |

| 2018 | 0.65 | 0.19 | 0.84 | |

| 2017 | 0.66 | 0.20 | 0.86 | |

| 2016 | 0.68 | 0.21 | 0.89 | |

| 2015 | 0.73 | 0.21 | 0.94 | |

| 2014 | 0.79 | 0.24 | 1.03 | |

| 2013 | 0.90 | 0.25 | 1.15 |